The Truth About Forex Trading Traders’ secrets

The fx market offers many opportunities for higher gains by means of margins and leveraging. For instance, an initial investment of $1000 can give you a start of around 10 cents per pip. This is a big advantage especially for the small beginner trader.

The forex market is so vast that there is room for everyone to trade and make profits. This can put unnecessary pressure on you, especially if you are starting or are not yet comfortable with your strategy. Waiting until you have more experience and confidence can help you avoid this pressure. It is crucial to remember that everyone has a different trading style, and what works for one trader may not work for another.

Blunt Truths About Forex Trading: From a Pro Trader

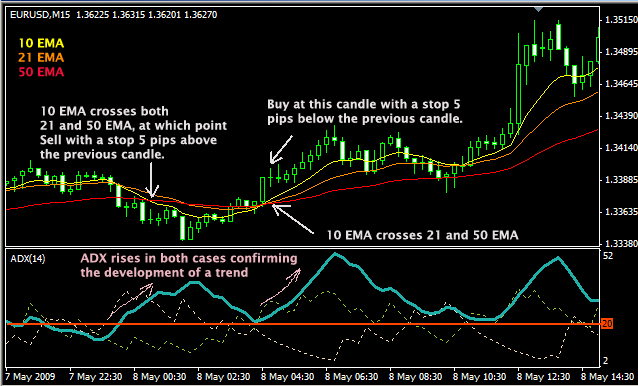

Many successful traders will look to combine fundamental and technical analysis so as to be in a position to draw on as wide a range of data as possible. A financial background can be useful for understanding how forex and other markets work. However, more beneficial are skills in math, engineering https://topforexnews.org/books/currency-trading-for-dummies-by-mark-galant-brian/ and hard sciences, which better prepare traders for analyzing and acting on economic factors and chart patterns. While it would be nice to think that if a trader makes money trading once per day, they can make 10 times as much trading 10 times a day, this is generally not the case.

Spending time developing a trading strategy that suits your personality, risk tolerance, and trading goals is vital. This may involve backtesting various systems or seeking guidance from a reputable trading mentor. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. By keeping this frame of mind, you ease the pressure on yourself to always be right about what the market will do next or having to take a loss. In doing so, you overcome the fear of losing money, which is inevitable to every trader as losing a tooth is to every person.

- In this post, I’ll reveal 11 bitter truths about forex trading that everyone is keeping from you.

- Any expectations you have will be a source of tension and may drive you to view market information as dangerous.

- “Expect this learning curve to be measured in years,” says Brown, who recommends reading Trading in the Zone by Mark Douglas and Reminiscences of a Stock Operator by Edwin Lefevre.

- To develop a consistent mentality in trading, you must first accept that trading is not about hoping, wondering, or accumulating evidence one way or the other to decide if the next trade will succeed.

When setting your investment goals, remember to set something aside to ride out any losses you may experience. This may look insignificantly small but it really does add up to a substantial profit during trade. You can adjust your thousand-dollar account to a lot size that leverages $1000 on a mere $100 margin. Anyone with even a casual interest in currency trading online must have noticed the barrage of online advertisements inviting newcomers into the fx exchange market. The myth of late entry in forex trading refers to the belief that entering a trade after it has already started moving in a particular direction is too late to profit from.

What Is Forex Trading? A Beginner’s Guide

I regret not knowing this back in 2007 when I began this journey. Doing this gives you a deeper understanding of the market and what works best for you, allowing you to make better-informed decisions and trade more confidently. Having a separate source of income can also provide additional funds that you can use to invest in Forex trading. Start with capital that allows you to make trades comfortably without risking too much of your funds. It’s important to remember that the forex market is highly volatile, and risks are always involved. This mindset often leads to reckless decision-making, over-trading, and, ultimately, losing money.

This has to be said, a lot of very successful traders never even started high education. Have you ever heard about some Forex trading college or university? Because if you want to be a successful Forex trader you must have particular skills. Speaking about those skills, for the profitable Forex trader is more useful to be a strong personality, not to get panicked when trades go in an unexpected direction. If you are nervous and without self-confidence, then Forex trading isn’t for you.

Forex Terms

One of the most important things to remember when trading Forex is that the only strategy that works is the one that makes money for you. Any business you treat like a quick-rich scheme will also treat you like a fool because you could lose all your funds in a twinkle of an eye. Unfortunately, I eventually lost all the funds and experienced many sleepless nights dreaming about lot sizes and trades.

Dow Jones ASX 200 Hang Seng Analysis Key level to watch – FOREX.com

Dow Jones ASX 200 Hang Seng Analysis Key level to watch.

Posted: Tue, 18 Jul 2023 03:16:08 GMT [source]

You set yourself up for unnecessary pressure and self-inflicted emotional blackmail as you try to pay back and still meet up with loan interests quickly. Also, trading profits can fluctuate and will not always be consistent. Suppose you struggle to control your emotions while trading, take a step back https://currency-trading.org/strategies/previous-day-high-and-low-breakout-strategy-by/ and practice self-awareness. Recognize when emotions start affecting your decisions and take a break to refocus. While useful, a line chart is generally used as a starting point for further trading analysis. When we are pushing the buttons to place our trades, actually we are pulling the triggers.

You can build up a more holistic portfolio than just forex trading if you wish to. However, only do this on a trusted platform because there are many scams on platforms that falsify your trades and make you think you are making, thereby luring you into committing real funds. Duncan says that markets are highly efficient and even if someone has developed an algorithm, by the time it is widely marketed, the market will have discovered it and be trading against it. He explains that, if you take a position that the dollar will strengthen against the rand and you are paying a 10% interest rate, the rand must depreciate by more than 10% to make a profit. The reality is that they are trading aggressively and closing positions daily, which just adds to the cost of trading. Duncan adds that many of these courses or online forex platforms convince you that they have algorithms or trading systems that can beat the market.

Unexpected Events

We have seen many times a positive bit of news making the markets go down, it doesn’t always make sense, and that pretty much sums up the markets. If anyone could actually predict them, then they would be a billionaire, but alas, this is not a thing and no one is able to do it. So we are going to be looking at some of the truths of forex trading, some of the things you may not have been told as well as removing some of the sugar coatings that may have been put on. Successful traders see the market differently than others, they understand that trading is a probability game or a number game, and they always accept and move on from random results of their trades. To be a profitable trader, all you need is a trading system/strategy with a higher win rate. All you can do is execute your trade plan and let your edge play out.

You may find an asset that has a wide spread but represents a strong opportunity due to its volatility. Similarly, you may find an asset with high liquidity and a tight spread, but that isn’t showing much trading potential. Above all, you should let your trading decisions be governed by setups presented by the market, not the size of the spread. Here are some steps to get yourself started on the forex trading journey. Being a successful trader doesn’t mean that someone is naturally predisposed for that. That isn’t something the mother will give you with a birth.

A Trading Edge Is Not About Win Rate Or Your Entry and Exits

This is not necessarily true, as there are many opportunities for profitable trades throughout the life of a market trend. I have an account on Instagram myself, where I publish forex trading content. Borrowing money will influence your trading psychology and cause you to take unnecessary risks. Focusing on your returns, or the percentage of your investment earned, will give https://day-trading.info/infinox-media-client-reviews/ you a better understanding of your overall success. One thing to remember is that Forex trading is not a guaranteed source of income, and there will be times when the market goes against you. If your trading affects your job, turn your forex strategy and idea into a robot or expert or even a semi-expert that sends you a signal to your mobile phone while you do your job.

News Nuggets 18 July: Binance and CS to Cut Staff; Big Banks Partner on FX Trading – Finance Magnates

News Nuggets 18 July: Binance and CS to Cut Staff; Big Banks Partner on FX Trading.

Posted: Tue, 18 Jul 2023 08:41:01 GMT [source]

Don’t get panic by trying to understand every movement in the market. If the trade move in your favour, give it some time to play out. We have seen the price action bounce from support level from time to time. But the price movement isn’t performing the same way around the support level, is it? Sometimes the price will reach the support level and shoot like a rocket, and other times the price may hold the support level for a while before shooting off. In life, there are no short cuts, especially when trading in the forex market.

Waiting a while before telling everyone you are a forex trader can help you avoid unnecessary pressure and interference and protect yourself from potential scams. While both involve placing bets, forex trading is not based solely on chance or luck but rather on analyzing market trends, understanding economic indicators, and making informed decisions. After facing a setback with my previous broker, my dad deposited funds with a new broker called Marketiva, where I began trading with 10,000 quantities, we call them lot sizes today in other brokers. I will not be filling these pages with useless trading content, and bore you to tears with basic market theory which is available for free on Google searches. I’m going to go straight into the meat, and divulge to you, not only a successful trading method, but help you understand what will help make you successful in the forex market.

- The lure of quick riches is a common pitfall many fall into when they enter the world of forex trading; therefore, it is essential to recognize that Forex is not a get-rich-quick scheme.

- High leverage has made short-term forex trading popular, but this is not the way it has to be.

- Focusing on your returns, or the percentage of your investment earned, will give you a better understanding of your overall success.

- My systems work for many, and can work for you, but you must be realistic.

So, the London Stock Exchange is the trading hub for Forex deals. The volume of trading in Forex markets stands at more than $5 trillion a day, much more than the volume on the New York Stock Exchange. Did you know that the GBP/USD currency pair is known as the Cable in the forex market? How much does the transaction per day in the Forex market translate to?