Income Smoothing: Definition, Legality, Process, and Example

Income smoothing is an accounting practice used by companies to reduce the fluctuations in their reported earnings over time. By adjusting the timing of revenue and expense recognition, firms can create a more stable financial performance picture, making it easier for investors and analysts to assess their ongoing profitability. This practice raises questions about accounting quality and can be a form of earnings management when used excessively or misleadingly. Income smoothing is the shifting of revenue and expenses among different reporting periods in order to present the false impression that a business has steady earnings.

Distorted Financial Analysis

These practices allowed Enron to present a consistent pattern of earnings growth, deceiving investors and analysts. Financial stability is crucial for the success and sustainability of any business. Income smoothing is a financial strategy that involves managing and adjusting a company’s reported earnings to achieve a more stable and predictable income stream. In this article, we will explore the concept of income smoothing and its benefits. It is more likely that the term income smoothing is used to mean reporting misleading earnings, creative accounting, and aggressive interpretation of accounting principles and concepts. Perhaps a company increases its allowance for doubtful accounts with an increased bad debts expense only in the years with high profits.

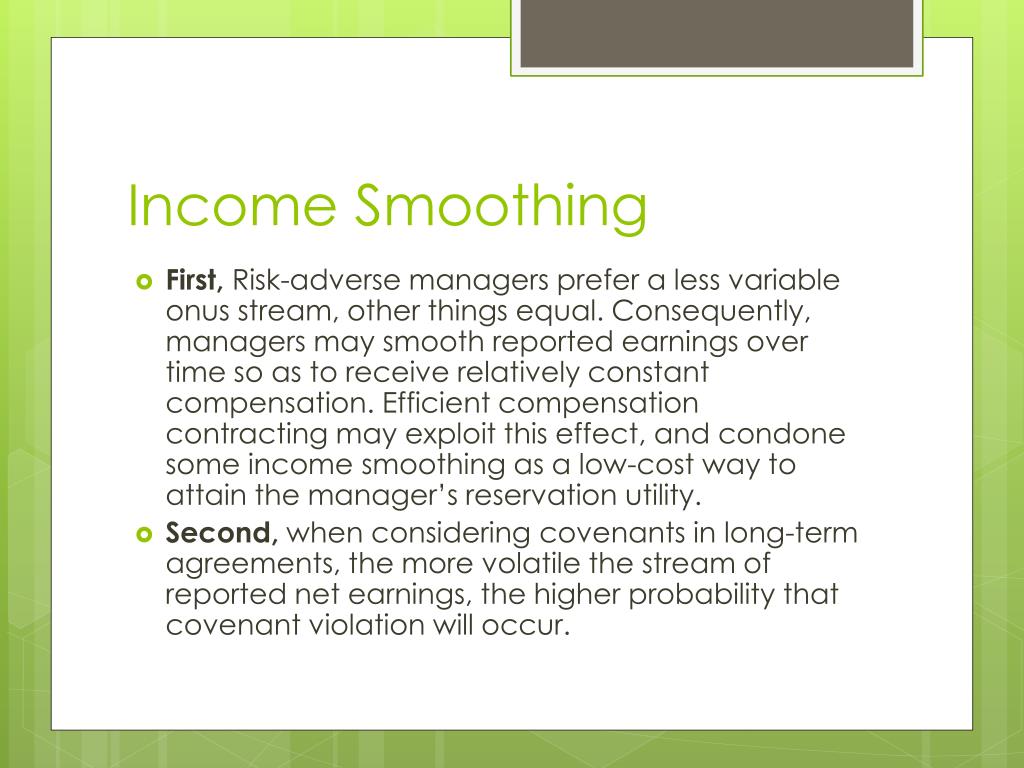

Reasons

- During the holiday season, the company generates significant revenue, while in other months, the sales decline.

- For example, a business may defer recognizing income in a profitable year to future years, or accelerate the recognition of expenses in a less profitable year.

- The answer is yes, as long as it is done ethically and in compliance with accounting standards and regulations.

- The goal of income smoothing is to reduce the fluctuations in earnings from one period to another to portray a company as if it has steady earnings.

- Many businesses, especially auto companies, have warranty policies, under which they promise to repair or replace certain types of damage to its products within a certain period following the sale date.

While income smoothing can offer benefits, it has also been subject to criticism. Critics argue that smoothing earnings can distort the true financial picture of a company and make it difficult for investors to assess its actual financial health and performance. Deferred accounting is a fundamental concept in financial reporting that involves the recognition of revenue and expenses at a later date rather than when the corresponding cash flow occurs. A deferral is recorded in the income account only sometime after payment or receipt has occurred.

Income Smoothing: Definition, Legality, Process, and Example

Income smoothing is the practice of adjusting financial reporting to reduce fluctuations in earnings, making them appear more stable over time. This can be accomplished through various methods, such as revenue recognition timing, expense shifting, and establishing reserves. Companies often engage in income smoothing to meet expectations from stakeholders, such as investors or analysts, which can sometimes lead to ethical concerns regarding the transparency of financial statements.

Business Strategy

Then when earnings are higher, the corporation will increase spending for personnel and get caught up on the maintenance it had put off. Get new tipps on retirement savings, investment decisions and antifraud tipps. The larger names would book billions of apartment sales each year, often with only a small deposit having been paid.

Income smoothing involves reducing the fluctuations in a corporation’s earnings. The reductions in fluctuations can result from some legitimate business methods to fraudulent ones. By promoting transparency, accountability, and adherence to accounting principles, we can strive for a more reliable and trustworthy financial system that benefits all stakeholders. Many businesses, especially auto companies, have warranty policies, under which they promise to repair or replace certain types of damage to its products within a certain period following the sale date. By the time of its demise, Enron had a lot of cancelled projects that investors believed were still being developed.

Income smoothing, also known as earnings management, is the process of intentionally altering a company’s financial results to create a more stable pattern of earnings over time. The goal is to reduce the volatility of reported earnings, making income smoothing describes the concept that them appear more consistent and predictable to investors and stakeholders. Income smoothing is a financial practice that involves manipulating a company’s reported earnings to create a more consistent and predictable stream of income.

Manipulating financial results can be seen as a violation of accounting standards and securities laws. Companies found engaging in aggressive income smoothing may face regulatory investigations, fines, and reputational damage. Suppose PQR Ltd., an electronics company, experiences high sales and profitability during the year due to increased demand for its innovative home appliances. To ensure a more consistent financial portrayal, the company strategically sets aside a portion of its profits (say 8%) instead of reporting them entirely within the current fiscal period. This reserved profit acts as a buffer, allowing the company to adjust the financial books during the less prosperous years to present a stable income trend to investors and stakeholders.

There are many reasons why a company would choose to engage in income smoothing. These may include decreasing its taxes, attracting new investors, or as part of a strategic business move. Knowing the adverse effects such fluctuations have on businesses, accountants and financial experts adopt the use of income smoothing strategies. Earnings management occurs when accounts are manipulated so that they do not accurately represent a company’s true economic earnings. In most instances, companies manage earnings to inflate their perceived profitability. If a company’s financials show volatile earnings, an investor may be turned off by the risk and uncertainty of investing in this company.