Accounting for Consignment Inventory Definition, Treatment, Journal Entry, and Example

Consignment arrangements can vary significantly, each with its own set of terms and conditions. Understanding these different types is essential for businesses to effectively manage their consigned goods and ensure proper accounting and revenue recognition. In a consignment stock agreement, the supplier dispatches a stock of goods to a retailer while retaining ownership until the retailer sells them.

Advantages for consigners (suppliers/product owners)

A consignment warehouse is a storage facility managed by the supplier to store goods, ensuring swift deliveries to retailers. With vendor-managed inventory (VMI), the supplier takes responsibility for managing the retailer’s stock levels. Now that you’ve learned essential information on consigned inventory, we invite you to see Xledger in action. Book a demo today to learn how we can help you optimize your consigned inventory management. Consigned inventory is not typically considered a current asset on the consignee’s balance sheet because legal ownership of the inventory remains with the consignor until it is sold.

What is Consignment Accounting?

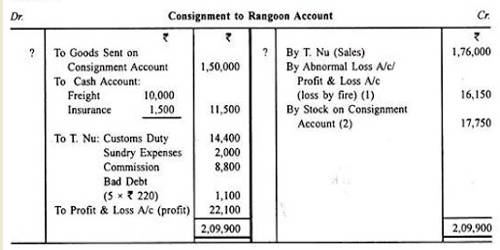

The accounting treatment for each stage may differ based on the consignors’ accounting policies. As mentioned, the consignee does not assume any responsibility for the inventory. Usually, a consignee may also enter into agreements with various consignors. The consignor purchases their inventory and pays for the consignment inventory to be delivered to the consignee. The consignee sells the consignment inventory in return for a 10% commission.

- However, it’s essential to note that consigned goods are part of the supplier’s inventory exclusively.

- To make your business function more smoothly, we assist you with demand predictions, reorder points and more.

- Moreover, the consignor must account for any commissions or fees paid to the consignee.

- Additionally, the consignee may be responsible for collecting and remitting sales tax on the final sale to the end customer, depending on local tax laws.

Revenue Recognition for Consigned Goods

The amount is owed by the consignor and posted as a debit to the personal account of the consignor. The journal entry is either to accounts payable or cash credit, depending on the terms agreed with the supplier, and no entry is made by the consignor. It’s especially beneficial for retailers that are unsure of demand for the product. Taking inventory on consignment allows you to offer your customers a larger variety of goods with significantly lower financial risk since you aren’t paying for the inventory until it is sold.

Disadvantages of Consignment Inventory

In other words, they are the initial owners of the inventory that is meant for resale. If the entire consignment of inventory had not been sold, then only a proportion of the inventory would be transferred. The balance of inventory would be inventory still held by the consignee. As the inventory has now been sold, the consignee provides an account summary to the consignor. This report is referred to as an Account Sales Report and it lists all transactions the consignee has made concerning the consignment.

Suppliers may face challenges in maintaining control over their products, as they rely on consignees to effectively manage and promote the inventory. Additionally, disputes over damaged or lost goods can strain relationships between parties if not addressed promptly. After the month’s closing, the unsold goods were returned back to the consigner (Biggs Inc.). Therefore, there is a need to record the inventory receipt by crediting the Consignment Inventory Account and debiting the Finished Goods Inventory Account.

This dual recording process ensures that both parties’ financial records remain accurate and up-to-date. Once the retailer makes a sale, the supplier will profit and pay the retailer a commission (often 20-60% of final sales). babyquest foundation If the retailer fails to sell all the stock, they can return any unsold items to the supplier risk-free. In the consignment inventory management process, the supplier (consignor) negotiates terms with the retailer (consignee).

However, the consignment inventory model poses some risks for suppliers. We’ve put this guide together to shed some light on how to account for consignment inventory, including the most important journal entries you need to know. The credit entry to the commission income account represents the income earned by the consignee on the consignment sales. The amount is due from the consignor and is therefore posted as a debit to the personal account of the consignor.

A profit or loss on the sale transaction will arise from these two entries. Try Unleashed for free today or book a demo to learn how we can help your business make light work of consignment inventory accounting and stock management. Under the consignment agreement between the consignor and the consignee, the consignee is entitled to a 10% commission and records the consignment accounting journal entry for this commission. The significance of inventory for certain industries makes accounting and valuation a pertinent focus area. This is because changing inventory costing methodologies often requires systems and process changes.

A sale on approval arrangement allows the consignee to use or display the goods for a specified period before deciding whether to purchase them. During this period, the consignee can evaluate the product’s performance and market acceptance. If the consignee decides to keep the goods, the sale is finalized, and the consignee records the inventory and corresponding liability. This type of arrangement is often used for high-value or specialized items where the consignee needs to ensure the product meets specific criteria before committing to a purchase. It provides a trial period that can be advantageous for both parties, allowing for informed decision-making. Consigned goods should be recorded in warehouse management systems explicitly designed to support it, or consignment inventory software.

This is because a merchant typically owns a sizeable portion of the consignment merchandise they acquire. This is something that the consignor may take advantage of and showcase things to the market in a more limited way. When people hear the word consignment, they tend to think of consignment shops. Consignment items are brought to a place of business and sold on behalf of a person. However, consignment shops are not the only businesses that operate under this model. Your books have to be properly taken care of to ensure that everything will run smoothly.